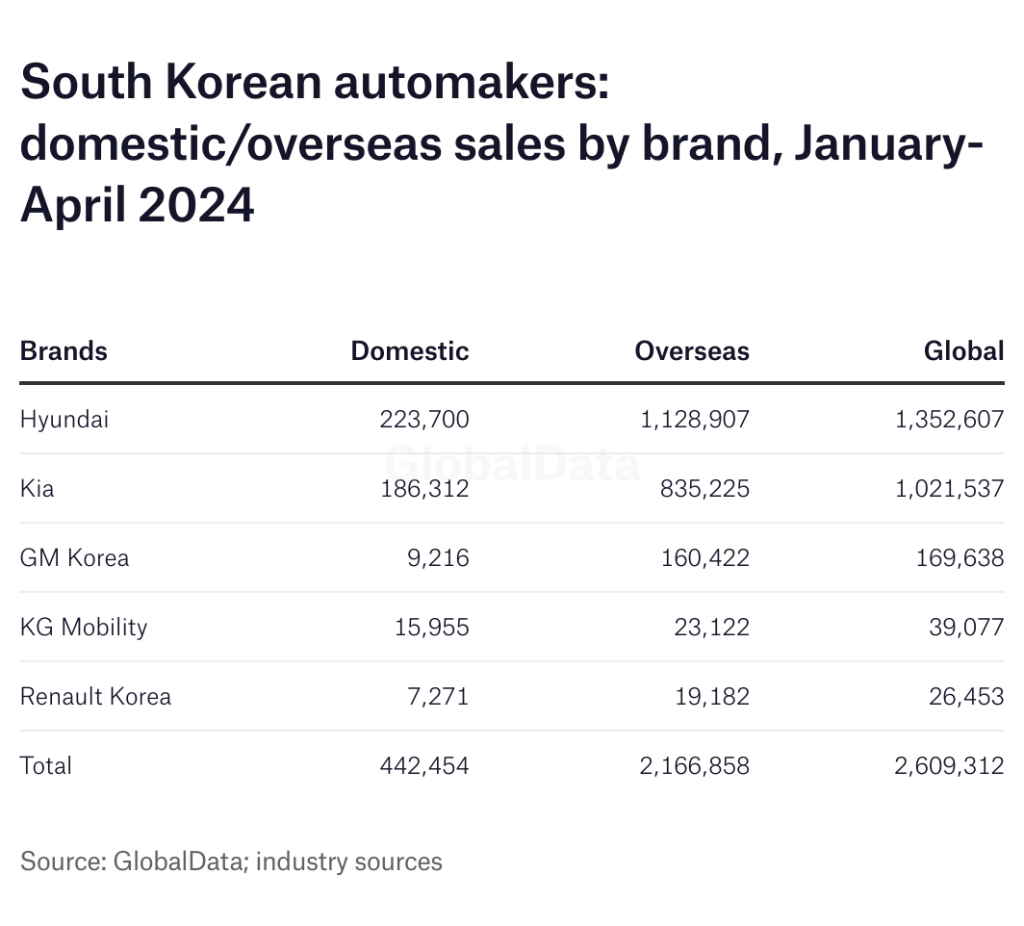

Domestic sales by South Korea’s five main automakers combined fell 7% to 119,414 units in April 2024 from 128,924 year earlier, according to preliminary data released individually by the manufacturers. The data did not include sales by low volume commercial vehicle manufacturers while import brands are covered in a separate report.

Last month’s decline followed sharper falls earlier in the year despite a pick up in domestic economic activity in the country in the first quarter, resulting in an 11% drop in cumulative four month sales to 442,454 units from 496,352 units.

The country’s highly indebted consumers have been struggling with the central bank’s interest rate hikes over the last few years, from 0.5% to 3.5%, with demand for battery electric vehicles (BEVs) particularly weak.

Most domestic vehicle manufacturers reported lower year to date (YTD) sales in the first four months of the year, including Hyundai with a 13% drop to 223,700 units with the company’s deliveries affected also by plant stoppages as it carried out production line refurbishment and maintenance work at some key facilities.

Kia reported a 3.2% decline to 186,312 units while KG Mobility was the worst performing domestic brand with sales plunging 44% to 15,955 units followed by Renault Korea with a 17% drop to 7,271 units. Only GM Korea reported higher domestic sales YTD, albeit with just a 2% increase to 9,216 units.

Global sales by the country’s five top automakers, including vehicles produced overseas by Hyundai and Kia, increased slightly to 2,609,312 units YTD from 2,596,109 units in the same period of last year, underpinned by a 4% increase in overseas sales to 2,166,858 from 2,091,485 units.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Hyundai Motor global sales rose 3% to 345,840 units in April from 334,890 a year earlier, with weak domestic sales offset by stronger overseas sales. The automaker said its global BEV sales exceeded 19,000 units last month. Total volume in the first four months of 2024 was slightly lower at 1,352,607 from 1,356,717 previously.

Domestic sales fell 4% to 63,733 units last month from 66,660 a year earlier, including 11,784 Genesis vehicles and 51,949 Hyundai. YTD sales were down 13% at 223,700 from 257,707 units, with sales affected by production line refurbishment and maintenance work at some factories in the first quarter. The company introduced a facelifted, extended-range Ioniq 5 BEV in March and should introduce the Ioniq 7 BEV by the end of the year.

Overseas sales rose 5% to 282,107 units in April from 268,230, driven by strong demand in North and South America and in India, while YTD volume was up 2.7% at 1,128,907 units from 1,099,010.

Hyundai aims to sell 4.24m vehicles globally in 2024, including Genesis, a slight increase on last year’s volume. The company lowered its domestic sales forecast to 704,000 units, while increasing its overseas sales expectations to 3.54m helped by the anticipated completion of its Metaplant Georgia facility in North America in the fourth quarter.

The company said it was working on optimising its product line and vehicle supply management in all regions to maximise efficiency and profitability. It also said it plans to strengthen BEV production, establish flexible business strategies to adapt to market changes and “reinforce pre-emptive risk management capabilities”.

Kia global sales increased slightly to 261,022 units in April from 259,397 a year earlier, with higher overseas sales offsetting weaker domestic volume. Cumulative four month sales were also down just slightly at 1,021,537 units from 1,027,648, including limited volume of special purpose vehicles (SPVs) such as military vehicles.

Domestic sales, including a small number of SPV exports, fell 3.4% to 47,941 units last month from 49,650 a year earlier with the Sorento and Sportage SUVs and the Carnival MPV the best selling models. Year to date sales were 3.2% lower at 186,312 units from 192,405 previously.

Overseas sales increased 1.6% to 213,081 units in April from 209,747 while cumulative YTD volume was flat at 835,225 units from 835,243 underpinned by strong demand for the Sportage and Seltos SUVs and the K3 sedan.

Earlier this year, Kia said it aimed to sell 3.2m vehicles in 2024, including 530,000 locally, 2,663,000 overseas and a further 7,000 SPVs worldwide. The automaker said it would continue to expand its BEV line worldwide with the launch of new EV3 and EV6 models in the second half of the year, as well as a new K4 sedan.

Kia said it aimed to complete the redevelopment of its Kia AutoLand Gwangmyeong BEV plant this year which would produce the compact EV3 and EV4 for domestic and overseas sale. The medium term plan was to sell 4.3m vehicles annually by 2030, of which 1.6m were expected to be BEVs.

GM Korea global sales increased 8% to 44,426 vehicles in April from 41,233 units a year earlier as the automaker continued to enjoy strong demand following the introduction of the new Trax crossover at its Changwon plant last year. Sales in the first four months of the year were up by 36% at 169,638 units from 124,456 units a year earlier, with the Trailblazer SUV and Trax by far the company’s best-selling models albeit with most output shipped overseas.

Local sales plunged 56% to 2,297 units last month from strong year earlier sales of 5,230 units while year to date volume was up 2% at 9,216 units from 9,067 units. In addition to the Trax and Trailblazer, the company’s local line also includes the Bolt EV, Colorado and Sierra Denali pickup trucks and the Equinox, Traverse and Tahoe and Cadillac Lyric SUVs.

Exports increased 17% to 42,129 units in April from 36,003 while YTD volume was up by 66% at 160,422 units from 107,057 previously.

KG Mobility reported a 1.5% fall in global sales to 9,751 vehicles in April from 9,899 units a year earlier with sharply lower domestic sales offset by rising exports.

Cumulative four month sales were down 13% at 39,077 from 44,892 units. The company, previously known as Ssangyong Motor, was acquired in late 2022 by a consortium led by local steel and chemicals firm KG Group.

Domestic sales plunged 34% to 3,663 units last month from 5,583 a year earlier amid sluggish demand and as competition from other domestic manufacturers and importers continued to intensify. YTD domestic sales were down by 44% at 15,955 from 28,402 units, despite the launch last year of the new Torres EVX SUV powered by lithium iron phosphate (LFP) batteries. The company said it planned to strengthen its local sales network to help lift domestic sales.

Exports rose 39% to 6,008 in April from 4,316 a year earlier and by 40% to 23,122 units YTD from 16,550 units after the company signed a number of significant export orders from Middle East distributors in the last two years while sales in markets such as Australia, Turkey and in Europe also increased.

Earlier this year a KG Mobility spokesperson said: “We are focused on increasing exports, which continue to rise, and strengthening our position in the domestic market including by improving customer satisfaction.”

Renault Korea global sales rose 10% to 10,572 vehicles in April from 9,580 units a year earlier, reflecting higher exports while domestic sales were slightly lower. First quarter global sales were down 38% at 26,453 from 42,396 units.

Domestic sales fell slightly to 1,780 vehicles last month from 1,801 as the company continued to struggle with rising competition from domestic manufacturers and from imports. YTD domestic sales were down 17% at 7,271 units from 8,771 units.

Exports increased 13% to 8,792 vehicles in April from a weak 7,779 units a year earlier but were down 43% at 19,182 units in the first four months of the year from 33,625 units.

The company said it continued to overhaul its product range with plans this year to phase out its aging SM6 mid size sedan, a throw-back to the time when Samsung was still its joint venture partner. The company had now adopted Renault’s global Losange emblem for the domestic market and said it would focus mainly on producing SUVs, BEVs and hybrids to help revive sales.

Earlier this year Renault Korea said it planned to launch new hybrid models under its Aurora 1 programme, including a Geely based mid-sized hybrid SUV in the second half of 2024.

The company had also agreed with Geely group to produce the Polestar 4 BEV at its Busan plant from the second half of 2025, for sale locally and for export.

Management had also discussed sourcing EV batteries with local producers LG Energy Solution, SK On and Samsung SDI.