Retail sales of light passenger vehicles in China fell 2% year on year to 1.585m units in April and 6% month on month, according to the China Passenger Car Association (CPCA), despite the Chinese government’s ongoing efforts to stimulate domestic consumption.

Sales in the first four months of the year were 9% higher at 6.42m units, driven by strong demand for new energy vehicles (NEVs) comprising mainly electric and plug in hybrid vehicles, sales of which increased by 35% to 2.48m units year to date (YTD) or almost 39% of total passenger vehicle sales.

Leading NEV manufacturer, BYD Auto, was behind much of this growth, with global deliveries surging 49% year on year to 313,245 units in April, including a 176% increase in overseas sales to 41,011 units. YTD sales were up 23% to 939,508 units, including 138,910 overseas sales.

Meanwhile, Tesla shipments from its Shanghai plant fell 18% to 62,167 units in April and 7% to 283,000 YTD.

Earlier this month, the automaker reappointed senior automotive vice president Tom Zhu, based in Austin, Texas, to take control of its China operations. He had previously been based in China, in charge of the copmpany’s Asia-Pacific operations.

China market price war

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to GlobalData, weak underlying demand means the price war has only intensified. Led by Tesla, OEMs are rushing to offer discounts and incentives for both NEV and ICE models. Prices of ICEs are falling rapidly, eroding automakers’ earnings, and the never-ending price war may be causing consumers to take a wait-and-see approach.

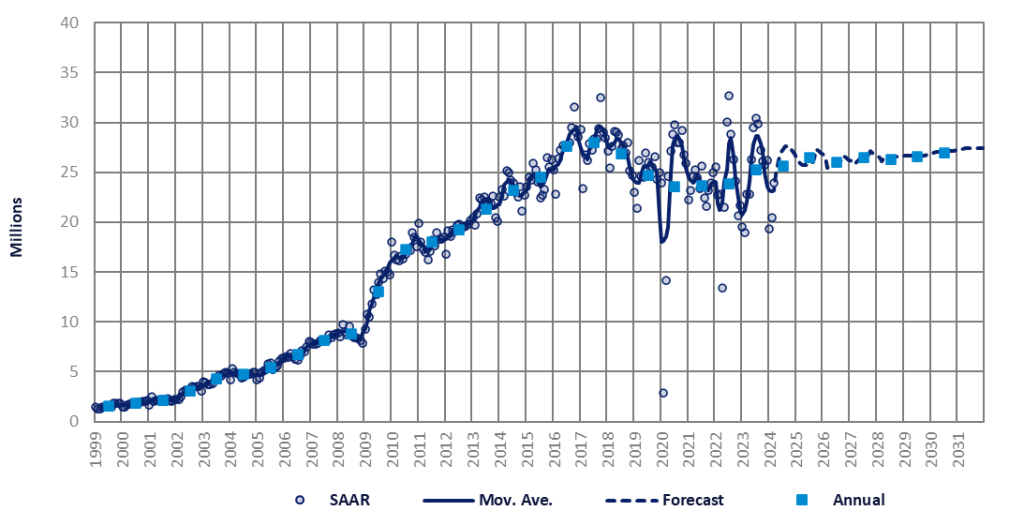

GlobalData forecasts that the 2024 light vehicle (LV) market in China will grow by just 2.1% to 25.8 million units, with a flat to low-growth trend for the medium term – with the market projected at around 27 million units in 2030. The annualised running rate trend (below chart) shows that China’s LV sales have been bouncing around according to volatile demand conditions and growing uncertainty over China’s economic prospects.