Light Vehicle production in North America for 2023 rose by 9.5% YoY – nearly 1.4 million more vehicles than in 2022. This growth was achieved by vast improvement in the supply of semiconductors, along with fewer parts supply issues, in general, and a stronger-than-expected regional demand environment, despite headwinds from pricing, interest rates, and economic uncertainty.

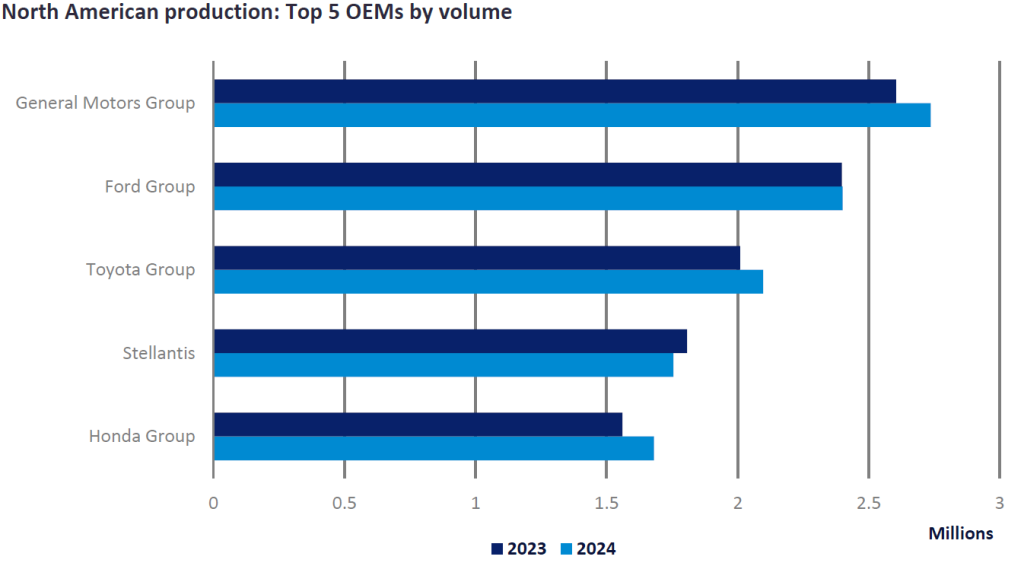

Most major OEMs flourished in 2023 with the exception of General Motors and Stellantis, who saw output fall by 1.4% and 1.9% from 2022, respectively. Stellantis’ decline was due to several factors, notably the UAW strike, the ending of Jeep Cherokee production – without an equivalent replacement yet in showrooms – and Jeep’s decision to move upmarket which impacted demand for the brand. Stellantis’ production pullback enabled Toyota to outproduce the automaker for the first time since the Great Recession and Chrysler’s bankruptcy. The manufacturers that saw the most growth in 2023 were Mazda (+47.5% YoY), RNM (+32.0% YoY), and Honda (+30.1% YoY), all of whom had more stable parts supply compared to 2022, which ultimately fed into a demand resurgence.

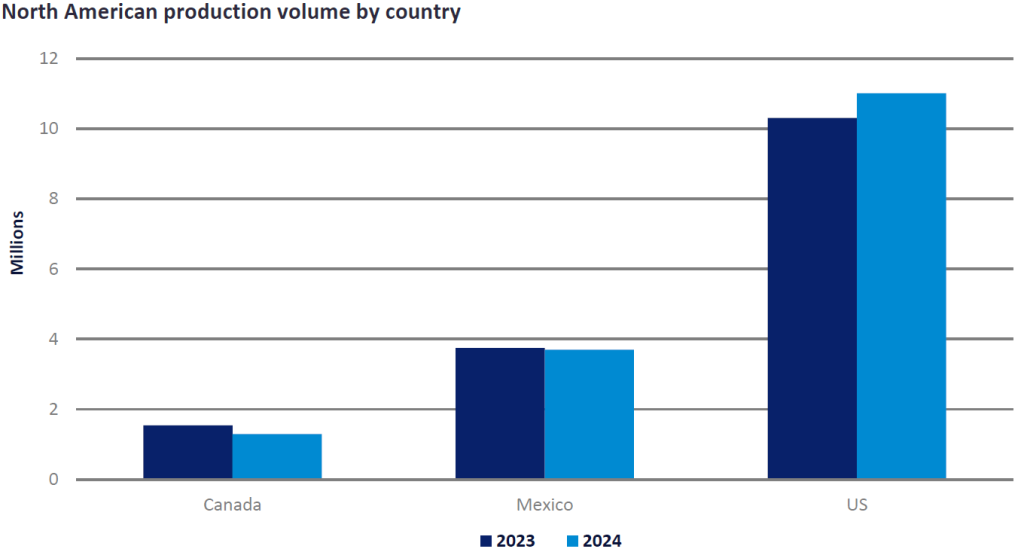

In 2024, we anticipate Light Vehicle production in North America to continue to rise to 16 million units, as a result of continued improvements in parts-related and other production disruptions, while regional demand growth is expected to remain positive despite high transaction prices and interest rate headwinds.

US output is projected to increase considerably, and we foresee a sizable portion of this growth deriving from Tesla as demand for the Model Y continues to soar and production of the much-anticipated Cybertruck begins to ramp up. Ford plans to add a third shift at the Michigan Assembly plant this year in order to churn out more units of the popular Ford Bronco and the recently redesigned Ford Ranger, further adding to the country’s production growth.

However, we project Canadian volumes in 2024 to be hampered by the planned shutdowns at Ford’s Oakville plant and Stellantis’ Brampton plant so that they can be re-tooled for BEV production. The Chrysler 300, Dodge Challenger, and Dodge Charger completed their lifecycles at the Brampton plant in December, while the Ford Edge is expected to end production at the Oakville plant in the coming months.

We also anticipate a slight decline in output from Mexico, mainly due to a few notable factors, including lower traditional Car demand regionally – in 2023, 24% of production in Mexico was that body type – and the midyear changeover for the redesign of the Nissan Kicks which should impact the output of that model this year, but set it up for a better 2025. Additionally, the current Volkswagen Tiguan is scheduled for a redesign in December, and because of this, we estimate production to be down slightly at the manufacturer’s Puebla plant. Although we anticipate a decline in both countries’ output for 2024, we do see volumes rebounding in 2025.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

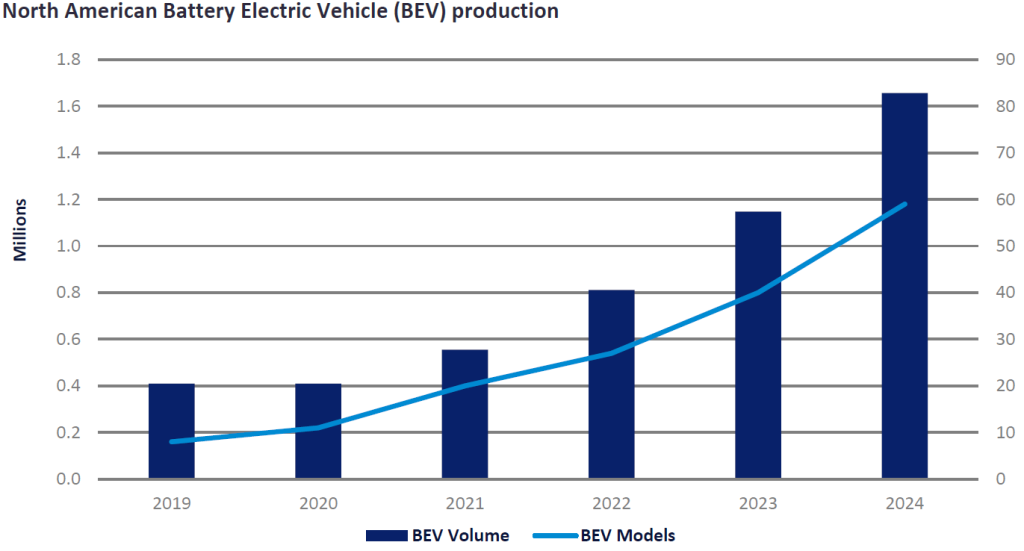

North American BEV production is expected to grow considerably as established and start-up OEMs expand their portfolios. In January, Honda began production of its first-ever North America-sourced BEV – the Honda Prologue – which is jointly produced with GM at their Ramos Arizpe facility , and rides on GM’s Ultium-battery BEV3 platform. This will be closely followed by the Acura ZDX, to be built at GM’s Spring Hill plant and also riding on GM’s platform. Starting this year, Stellantis plans to begin transitioning its next generation of vehicles onto the new STLA platforms that will have the flexibility to produce a mix of ICE, HEV, and BEV models. The all-new Dodge Challenger and Dodge Charger are to be produced at the Windsor plant while the Jeep Wagoneer S and Jeep Recon are to be produced at the Toluca plant – all to be underpinned by the new STLA Large platform. Stellantis is also planning to produce BEV and REPB (range extender) versions of its top-selling vehicle, the Ram 1500, which is to be underpinned by the STLA Frame platform at the manufacturer’s Sterling Heights Assembly plant.

In 2024, we anticipate a total of about 1.7 million units of production volume to be BEV from nearly sixty different models – accounting for over 10% of total North American production. However, there is a downside risk of launch delays and lower BEV output if electric vehicle demand softens.

Taylor Prodin, Analyst, Americas Vehicle Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Cente

Related Company Profiles

General Motors Co

Stellantis NV

Toyo Tanso Co Ltd

Mazda Motor Corp

Honda Motor Co Ltd