Vietnamese automaker VinFast is poised to enter the Indian automotive market with a focus on the Battery Electric Vehicle (BEV) segment. However, the success of this strategic initiative is uncertain, given the significant challenges posed by the competitive landscape, the dominance of established players, and the cost-conscious nature of Indian consumers.

The Indian automotive market is extremely competitive and has seen international giants like General Motors and Ford exit after decades of operation. Even Toyota and Volkswagen have struggled to establish a significant presence. This competitive environment presents a formidable challenge for VinFast, a newcomer, to establish its brand and attract the value-seeking Indian consumer.

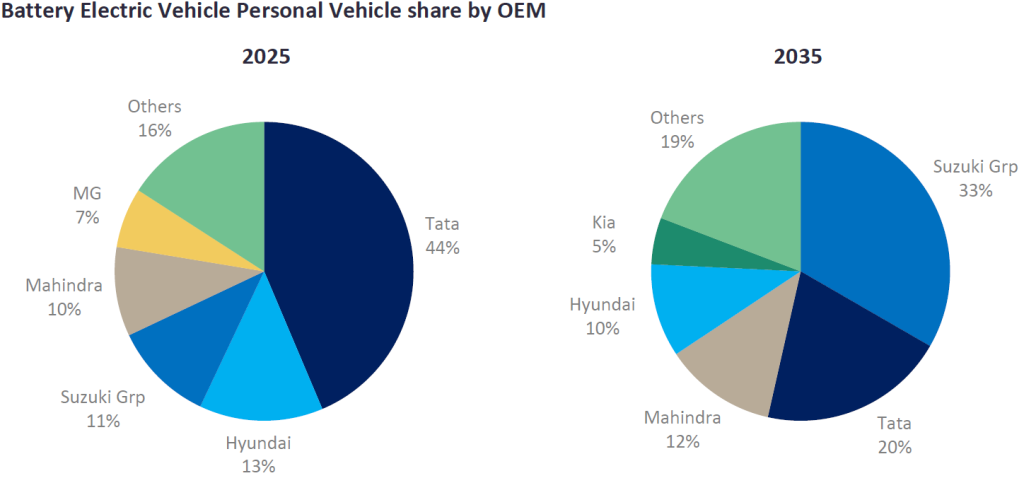

Moreover, VinFast will be entering a BEV market where local players are already established with Tata Motors expanding its offerings to a full line-up by the middle of this decade. Mahindra too is gaining a foothold and will be adding more BEVs to its product range. And, Maruti Suzuki, the market leader, is set to introduce BEVs by 2025. These companies benefit from a well-developed supplier base, enabling them to offer affordable BEVs and further intensify competition for VinFast.

With the construction of its manufacturing unit expected to be completed by 2026, VinFast’s market entry will thus coincide with the launch of BEVs by the major players.

Therefore, VinFast’s success in India will hinge on its ability to build a strong brand image and differentiate itself from the competition. As a new entrant, VinFast must navigate the preferences of highly cost-conscious buyers who are familiar with global automobile brands. The company’s strategic positioning will be critical in winning over customers in a market that values affordability, reliability, and brand loyalty.

See Also:

Additionally, VinFast’s value proposition must be compelling enough to overcome brand loyalty towards established players. The company’s ability to offer innovative features, competitive pricing, and a strong after-sales service network will be key factors influencing consumer acceptance.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

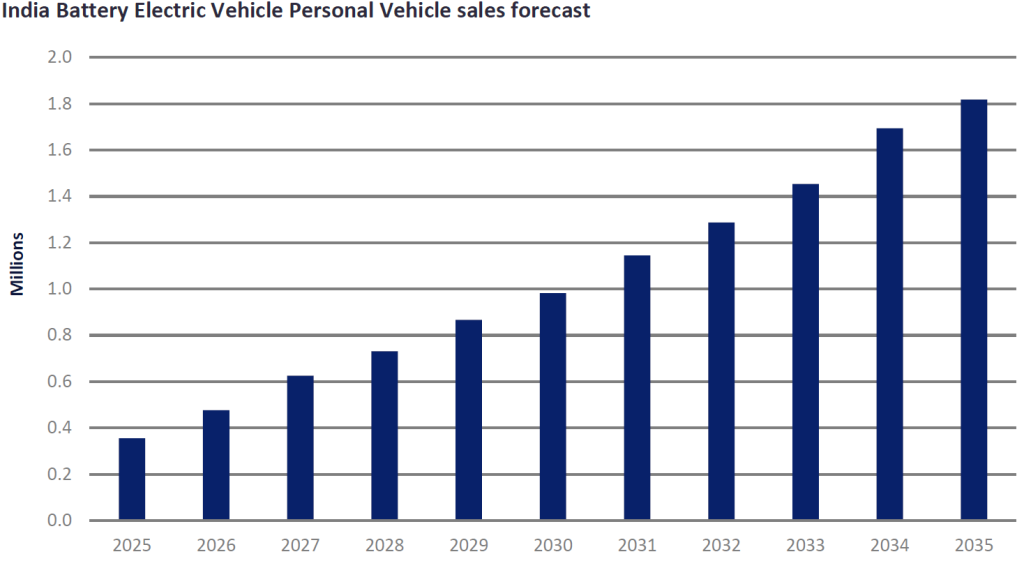

By GlobalDataGiven the competitive challenges and the brand-building efforts required, we project weak sales for VinFast in India. The forecasted sales of 1.5k units in 2026, with a gradual increase to 3.3k units by 2036, reflect our cautious optimism for VinFast’s growth in the Indian BEV market.

It is important to note that this sales outlook is based on our assumption of VinFast introducing four BEV models: VF e34, VF 5, VF 6, and VF 3. The success of these models will be influenced by their acceptance in the market, the pricing strategy, and the overall value proposition offered to Indian consumers.

In conclusion, VinFast’s foray into the Indian BEV market is a bold strategic move that will test the company’s ability to compete against established local giants and navigate a complex and cost-sensitive market. While there is long-term potential for growth, VinFast must overcome significant barriers to entry and consumer skepticism. Our low sales projections reflect the challenges ahead, but also the opportunity for VinFast to carve out a niche in the evolving Indian automotive landscape.

Ammar Master, Director, South Asia, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Hybrid & Electric Vehicle module, click here

Related Company Profiles

General Motors Co

Ford Motor Co

Toyo Tanso Co Ltd

Volkswagen AG

Tata Motors Ltd