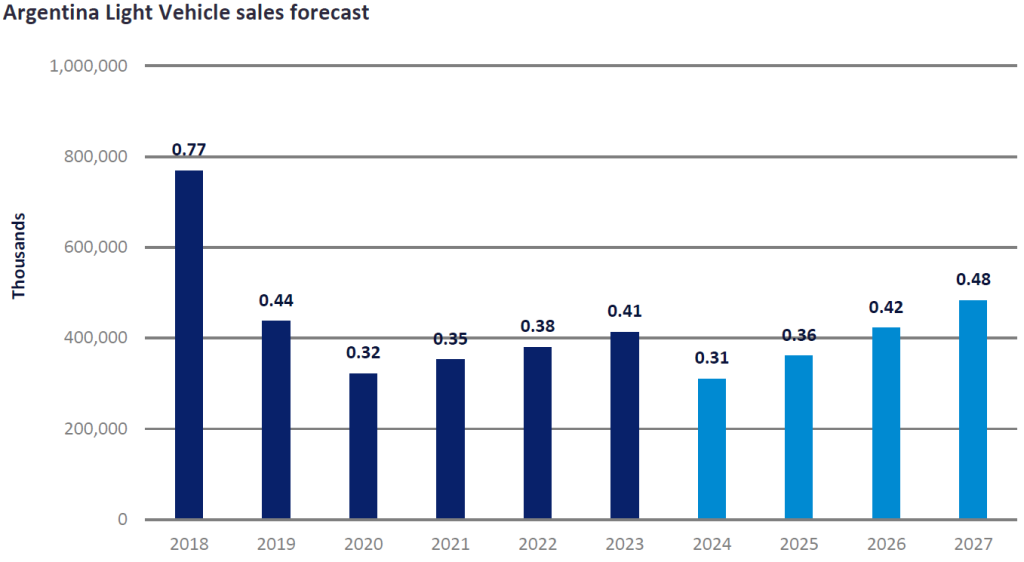

The automotive market in Argentina displays all the characteristics of your favourite rollercoaster, as the country saw its sales reach 769k units in 2018, before dropping to 322k units in 2020 due to headwinds associated with the COVID-19 pandemic and the semiconductor and parts shortages. The country has been constantly grappling with economic issues that have put a strain on its citizens and Light Vehicle (LV) sales. Recent developments in the economic outlook for the country could disrupt the auto industry, even as the government has opened the door to higher vehicle sales with the removal of a key mandate.

Just as it seems that Argentina has overcome one set of issues, another set of factors arise and continue to challenge the country. Javier Milei won Argentina’s presidential election in December 2023, and since entering office, he has proposed extreme policies that have added to the uncertainty of the outlook for 2024. Examples of such controversial proposals are to shut down the central bank and to “dollarize” the Argentinian economy, by transitioning from the Argentinian peso to the US Dollar. Consumers continue to struggle with elevated inflation levels, as inflation hit 276.2% in February 2024, and the rate is expected to remain in triple-digit territory for the remainder of 2024. Forecasts indicate that the country may fall further into negative territory before positive results emerge, as the GDP growth forecast for 2024 indicates that the economy will shrink by 4.2%. The economy is expected to see growth in 2025, as GDP is predicted to expand by 4.6%, once the country has adjusted to some of the measures put in place by the government.

Among the President’s package of reforms, in December the administration lifted the import restrictions impacting the auto market. The policy was put in place by the previous government as a way to build the country’s foreign currency reserves. However, the move had unintended consequences. The restrictions discouraged many OEMs from importing vehicles into Argentina, as it is costly for the automakers to import their vehicles and components. This gave the manufacturers who already had a strong production presence in the country an advantage. So, will the change bring positive results for the Argentine auto industry?

There is some encouragement to be taken from preliminary auto market estimates from February and March, which indicated that imports made up a slightly larger percentage of sales. However, it is probably too early to judge whether this is due to the policy change, or whether it is just that domestic sales are down. The new administration lifted the import restrictions with the idea of supporting the automotive market in mind, but the uncertainty in the economy could overshadow the potential gains from the change. Furthermore, some OEMs and suppliers are still struggling to import parts for vehicles due to debts previously incurred with import brokers. For example, General Motors suffered from a slowdown due to a supplier struggling with payments associated with import restriction debt accumulation, and the GM Alvear Complex in Santa Fe Argentina will be closed from 27 March until 14 April. The Chevrolet Tracker Small SUV is one of the main products produced at the facility, and this could be a blow to the OEM as the SUV is the automaker’s strongest vehicle in its line-up in Argentina. Sales for the Tracker are expected to reach 7k units by the end of 2024, which could change depending on the results of the shutdown.

In addition, it is not just the domestic situation that is causing a headache for OEMs producing vehicles in Argentina. The automotive industry has been struggling across the continent, with sales slowing in Chile, Colombia, and Peru, as those countries battle with looming recessions. Toyota recently announced a layoff proposal to its workers at the Zarate Argentina facility as exports to Argentina’s neighbours look set to shrink.

Looking ahead, Argentina’s situation may get worse before we start to see an improvement, as LV sales are expected to drop by 27% YoY to 311k units in 2024, down from 424k units reported the year before. With the citizens suffering from elevated levels of inflation and interest, it could be difficult to justify purchasing a new vehicle as the associated costs are too high. People are waiting to see the outcome of some of the policies put in place by the newly elected government. Overall, we believe lifting restrictions will result in a slight increase in imports. Imported vehicles accounted for 6.7% of sales in 2023, and as 2024 is the first year without the import restrictions in place, sales for imports could potentially account for 8.1% by the end of the year. As the country adjusts to the changes in its economic and political landscape, Argentina is expected to see its LV sales start growing again in 2025, as the lifting of the import restrictions could provide the boost that the market needs to push its economic misfortunes to the sidelines.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMark Radu, Analyst, Americas Vehicle Sales Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here