Honda had not changed its belief EVs “are the most effective solution in the area of small mobility products such as motorcycles and automobiles”, director, president and representative executive officer (global CEO) Toshihiro Mibe said at a business briefing.

“[Our] electrification target to make EVs and FCEVs represent 100% of [our] global vehicle sales by 2040 remains unchanged. Honda must look ahead to the period of EV popularisation and build a strong EV brand and a strong EV business foundation from a medium- to long-term perspective.”

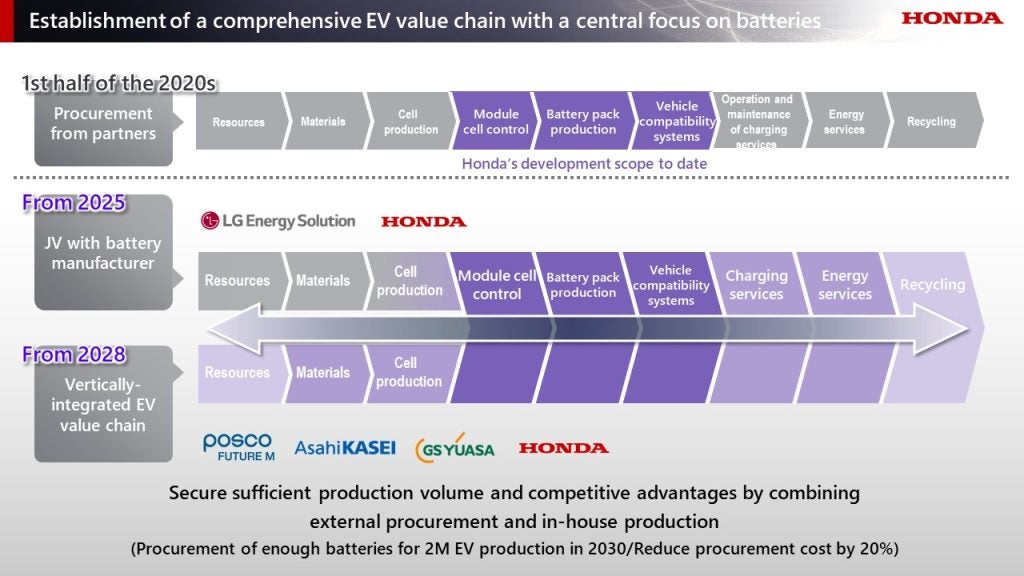

The automaker said it would reduce the cost of the battery to be purchased in America by “more than” 20% by 2030 through the establishment of a vertically-integrated EV value chain.

It would establish a “competitive business structure” aiming to reduce overall production cost by approximately 35%. It already had “a positive outlook” to secure enough batteries for the planned production of approximately 2m EVs per year.

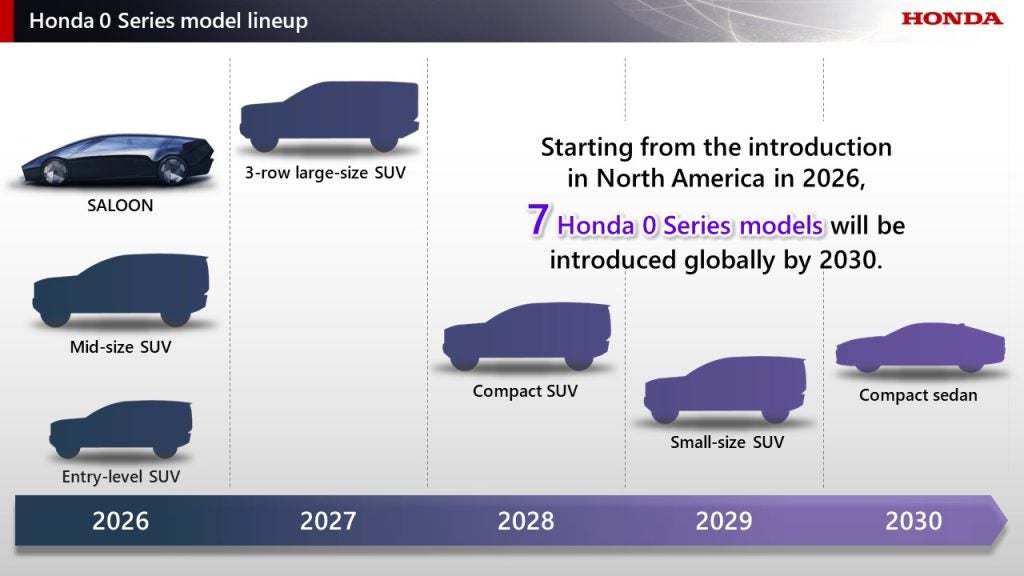

The 0 Series, which the automaker said it would “create from zero” with a new EV development approach of ‘Thin, Light, and Wise’, would be a flagship series of EVs with seven models launched worldwide by 2030 in all sizes. At CES last January, two concept models were unveiled: Saloon and Space-Hub. Saloon would be the flagship model and Honda is planning to launch a model “very similar to this concept model” in 2026.

Using the Mobile Power Pack (e: MPP), Honda would introduce a micro-mobility product with four MPPs in Japan before the end of FY2026.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

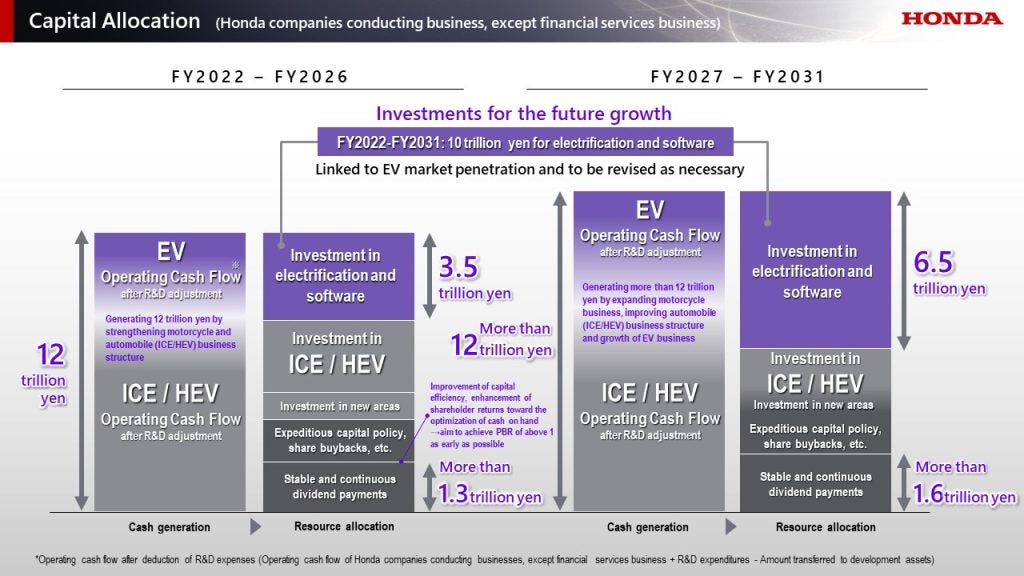

By GlobalDataThe automaker planned to invest JPY10 trillion in resources over 10 years through FY2031 “when the period of full-fledged popularization of EVs is expected to start”.

Honda would “pursue both bold investments for future growth and shareholder returns”.

Dramatic changes

Mibe said: “The environment surrounding automobile electrification is undergoing dramatic changes, and in some regions, the sense of a slowdown in EV market growth is gaining attention.”

There were various approaches toward Honda’s 2050 goal of carbon neutrality. For example, to achieve “zero environmental impact” in powering large mobility products such as aircraft and large watercraft, the use of SAF1 and e-fuel was viewed as a high potential solution, from the perspective of range.

In the area of small mobility products such as motorcycles and automobiles, and looking at the trend from a longer term perspective, Honda was confident the EV shift would “continue to proceed steadily”.

As of 2030, Honda planned to make EVs and FCEVs represent 40% of its global auto sales and to produce “more than” 2m EVs.

Honda was aiming to achieve a return on sales (ROS) of 5% for its EV business by then to further increase its profit margin to make its BEV business self sustaining.

The adoption of a new dedicated platform for mid- to large-size EVs and a further advanced power unit would result in “a package featuring unprecedented styling with a low vehicle height and a short overhang”, the automaker promised.

A newly developed compact e-Axle and ultra-thin battery pack would permit a thin motor room and floor.

A new power unit, lighter and thinner, would reduce overall vehicle weight by 100kg (220 pounds) compared to earlier Honda EVs.

Heavy components such as the battery and power unit would be placed low and in the centre of the vehicle body for a low centre of gravity, stable vehicle behaviour and “a nimble and sporty driving performance”.

The range target wass at least 300 miles (480 km) for each of the new 0 Series models.

Software

Using a new, in house developed vehicle OS, 0 Series models would have a digital UX optimised for each individual customer. Vehicle functions would be continuously updated with OTA (over-the-air) updates.

Honda would customise the SoC (system-on-chip) semiconductors which would feature AI, seen as “essential for the advancement of automation and intelligence, yet helps lower power consumption”.

“The EV models we will introduce in the second half of the 2020s will continuously advance in a way they will possess intelligence to be more attentive to the preferences and needs of each individual customer,” Mibe claimed.

The 0 Series would have centralised architecture to consolidate multiple ECUs which were serving individual functions to control the vehicle’s systems to a core ECU and serve as a single “brain” for the entire vehicle. This would align every function and make it possible “to speedily offer new and inspiring experiences never before possible”.

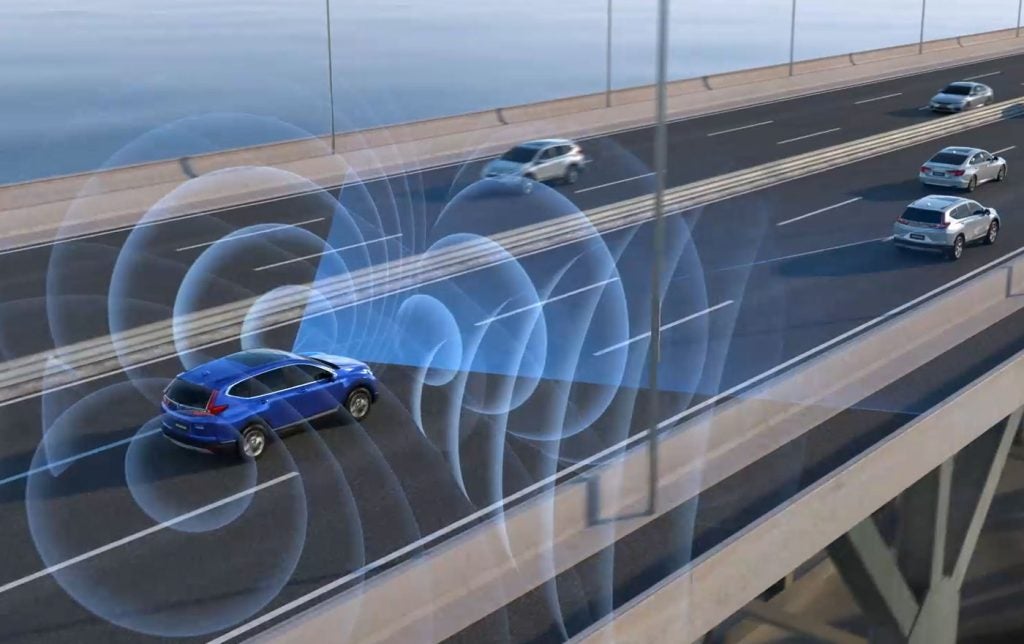

AD/ADAS would be advanced to be more in tune with human sensibilities by adopting further advanced sensing and intelligence technologies including AI.

Level 3 automated driving technology, which Honda claimed to have “put into practical use ahead of other companies around the world”, would be used to make automated driving functions available in a broader speed range on expressways, as well as on regular roads.

The EV plan

In these early days of EVs, the first half of the 2020s, Honda would “stably” procure the necessary volume of batteries while holding down the cost by strengthening external partnerships in each region.

In the transitional period, the mid-2020s, it would begin battery production with its JV partners with some Canadian projects already announced.

In the US, in 2025, the joint venture EV battery plant with LG Energy Solution would begin production with a capacity of 40GWh of batteries per year for the 0 series models.

Honda would also expand into the battery life cycle business, which includes charging, energy and reuse/recycle.

In the expected “popularisation period for EVs”, the second half of the 2020s, Honda would further expand by building a vertically integrated and comprehensive EV value chain with a central focus on batteries but including all aspects of EV production, from procurement of raw materials mainly for batteries, through production of finished EVs, as well as battery reuse and recycling.

In Canada, it would begin in-house production of the EV battery being co-developed with GS Yuasa and “internalise” production of key materials by producing cathode materials with POSCO FUTURE M and separators with Asahi Kasei at respective new joint venture plants to be constructed.

Advanced EV production

The transition from ICE to EV leading up to the mid-2020s would be a phase of flexibility to changes in demand and the business environment as existing factories would be used fully to produce both ICE and EV models on the same line.

For the thin battery pack, a new case production line to be installed at the Anna Plant in Ohio would be equipped with mega casting machines, 6,000 ton class high pressure die casting machines. This would reduce the total number of parts consisting of the battery case and secondary parts from 60 to five parts. Adding friction stir welding (FSW), investment would be reduced and efficiency increased.

Adoption of the Flex Cell Production System for battery production ahead of the start of full capacity EV output would enable flexible responses to changes in production models and fluctuations in production volume.

Most of these initiatives would be demonstrated at the dedicated EV plant operational in 2028 in Canada.

“By achieving the world’s top level production efficiency, including a significant increase in capacity utilisation rates and a reduction of fixed costs, [we aim] to reduce overall production cost by approximately 35% compared to conventional mixed-flow production lines,” Mibe said.

Internal research

Honda would also further advance all automobile business operations by linking them with software.