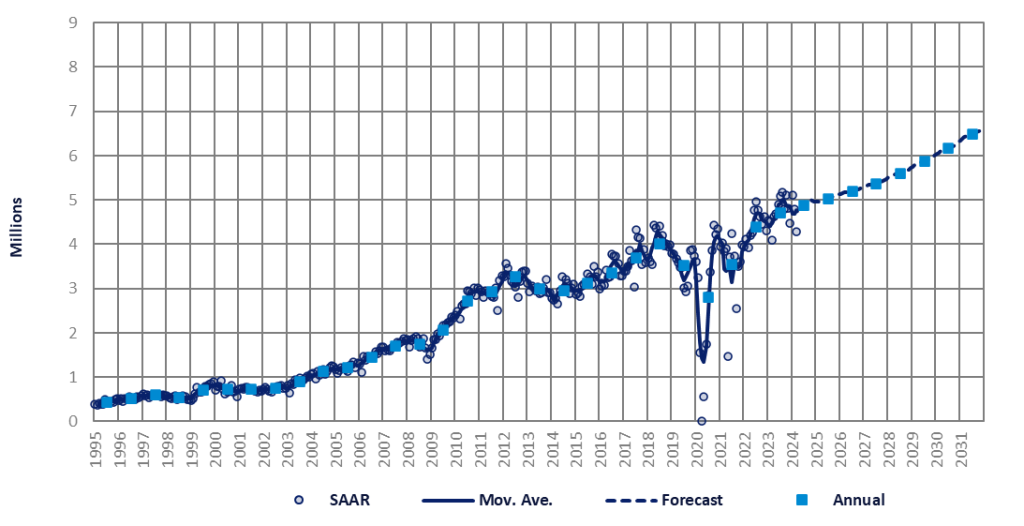

The Indian automotive market experienced a robust start to the year, but this momentum slowed in March, with a notable 11% month-on-month (MoM) decrease in the selling rate to about 4.3 million units. This marked the second consecutive MoM decline.

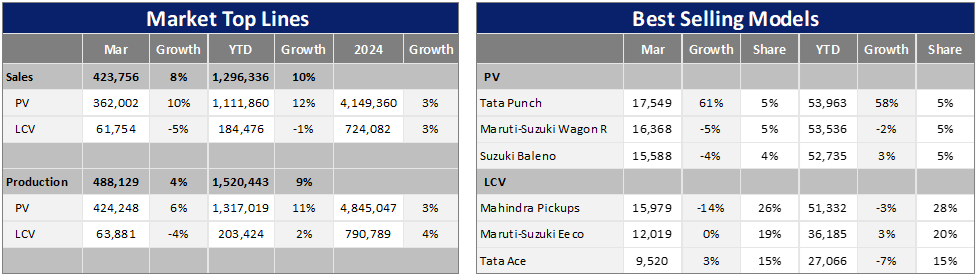

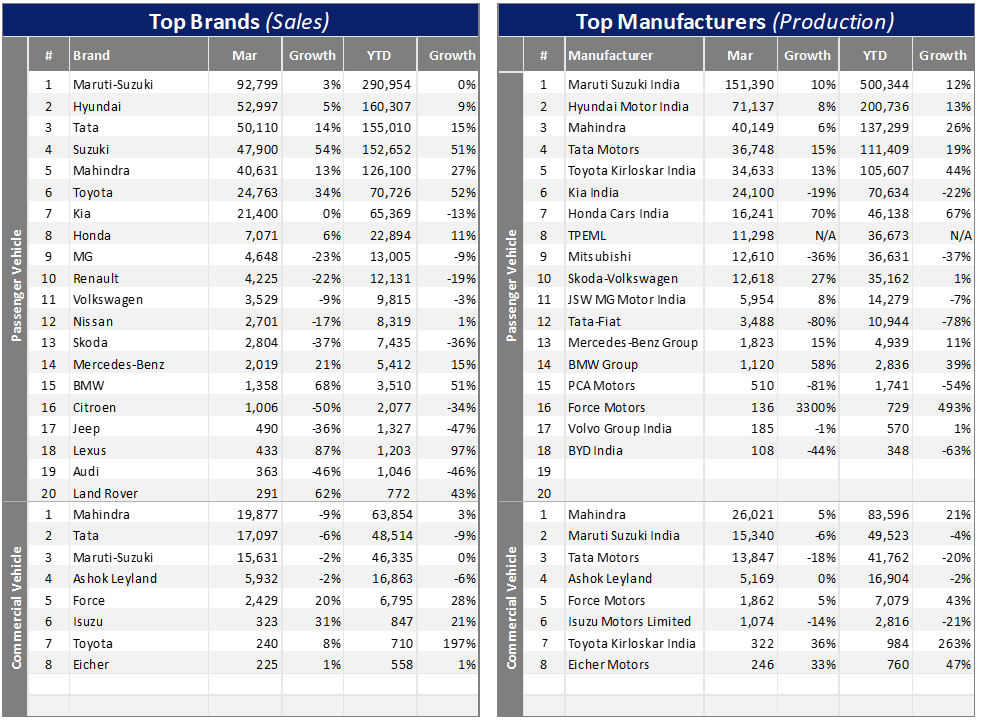

Despite this downturn, Light Vehicle (LV) wholesales remained resilient at 424k units, showing a slight 1% dip from the previous month but an 8% increase year-on-year (YoY). Passenger Vehicle (PV) sales were at 362k units (-1% MoM, +10% YoY), while dispatches of Light Commercial Vehicles (LCVs) with GVW up to 6T stood at 62k units (0% MoM, -5% YoY).

Automakers continued to streamline inventory for older and weak-selling models during the month. Reports indicate that dealership inventories of PVs in India surpassed 300k units at the start of April.

Demand also weakened, as consumers and businesses adopted a wait-and-see attitude because of the April/May general elections.

Nevertheless, a backlog of orders, the recently launched new models (mostly SUVs), and aggressive discounts from OEMs helped sustain sales. SUVs continued to be the market’s primary growth engine, as major OEMs have broadened their SUV offerings to include smaller models.

See Also:

Meanwhile, retail sales of PVs and LCVs declined further to 372k units in March, down from 379k units in February and 443k units in January, according to data from the Federation of Automobile Dealers Associations (FADA).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“The downturn (in the PV segment) was influenced by heavy discounting and selective financing further affected by economic worries and the electoral climate. Nonetheless, positives such as improved vehicle availability, increased stock levels and new model launches did stimulate demand in certain areas,” explained FADA President Manish Raj Singhania.

LV sales in Q1 2024 gained by 10% YoY to 1.3 million units, comprising 1.1 million PVs (+12% YoY) and 184k LCVs (-1% YoY). As a result, the selling rate averaged a robust 4.73 million units per year during the quarter.

Preliminary data for April indicate that PV sales may have remained stable or experienced nominal growth over the high base in April 2023. For example, PV wholesales for Suzuki Group declined by 1% YoY in April, while Hyundai‘s sales edged up by 1% YoY. Additionally, Tata Motors‘ PV volumes saw a modest 2% YoY increase.

Buyers are cautious because of the general elections, with entry-level buyers particularly absent from the market due to adverse macroeconomic factors.

Furthermore, FADA suggests that there are signs of weakened consumer confidence among urban Indians, leading to a reduction in discretionary spending amid persistently high financing rates.

Still, we anticipate that sales will pick up after the general elections, bolstered by a variety of new models and new model generations slated for release this year. Most importantly, SUV sales are showing no signs of slowing down, presenting a potential upside risk to our forecast.

Conversely, the downside risks to the 2024 forecast stem from the sticky inflation and high interest rates. Inflation continued to hover above the Reserve Bank of India’s 4% target, which has dampened expectations of an interest rate cut soon. This will likely stifle demand from buyers of small and entry-level cars.

Additional concerns include the impact of global warming on rural India, an uncertain global outlook, and rising oil prices – a significant issue for India as a major oil importer.

Although March sales fell short of our expectations, we maintain our forecasts. We project that LV sales will grow by 3% YoY to a new all-time high of 4.9 million units this year.

Related Company Profiles

Suzuki Motor Corp

Hyundai

Tata Motors Ltd