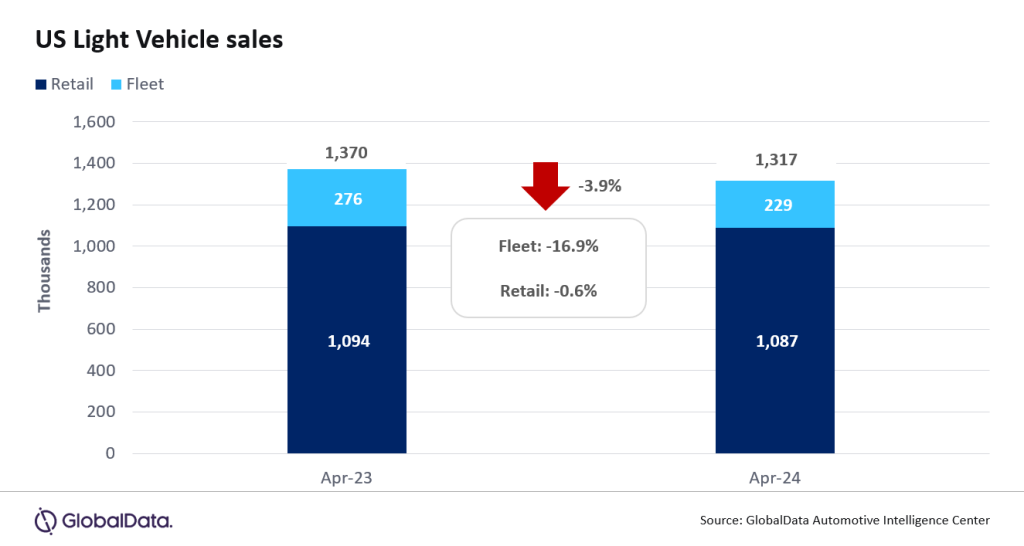

According to preliminary estimates, Light Vehicle (LV) sales in the US declined by 3.9% YoY in April, to 1.32 million units.

The 20-month YoY growth streak came to an end, but that was unsurprising given that April 2023 had an additional selling day. Furthermore, the pace of sales picked up significantly a year ago, making YoY growth much more difficult to achieve.

Global outlook – Global LV sales finished the first quarter at 20.7 million units, up 4% from Q1 2023. The selling rate averaged 83.0 million units during the quarter, with the March selling rate being largely in line with February. Sales volume grew just 1% from March 2023, with mixed results at a regional level. Domestic sales in China accelerated in March, increasing 4% YoY and, when combined with the 7% increase in North America, stable growth at the topline level continues. LV sales in Japan fell again, down 21% on suspension of production at Toyota and Daihatsu amid safety concerns. Europe was mixed with Western Europe contracting 1% YoY but recovery in Russia and Ukraine – and growth in Turkey – driving Eastern Europe to a 24% YoY increase. The outlook for 2024 is unchanged from last month at 89.2 million units, a 3% increase from 2023. This year remains a balancing act between supply and demand. As production constraints fully dissipate, natural demand will be able to be met at current price levels, keeping growth rates in check.

US LV sales totaled 1.32 million units in April, according to GlobalData. The annualized selling rate was 15.7 million units/year in April, up from 15.6 million units/year in March. The daily selling rate was estimated at 52,700 units/day in April, compared to 53,700 units/day in March. It is noteworthy that the April daily selling rate was almost identical to the rate a year earlier; the YoY fall was therefore attributable to the loss of a selling day. The market continues to display very mixed results, with some OEMs performing well, while others are struggling. According to initial estimates, retail sales totaled 1.09 million units in April, while fleet sales finished at approximately 229k units, representing around just 17.4% of total sales.

GM has now led the sales rankings for three straight months, after beating Toyota Group by around 10k units in April. At a brand level, Toyota was the bestseller, with sales of 183k units, around 18k ahead of Ford and with Chevrolet again in third at 144k units. For the first time since September 2023, the Ford F-150 was the bestselling model in April, at 40.7k units. The Toyota RAV4’s six-month streak at the top of the rankings came to an end, as it sold 39.1k units. The Ford F-150 likely benefitted from the release of 2024 model year vehicles that could not previously be sold due to a components issue. Compact Non-Premium SUV was once again comfortably the leading segment in April, but at 21.0%, its market share was the lowest of the year to date. Midsize Non-Premium SUV came in second on 15.7%, while Large Pickup saw its highest market share since December, on 13.3%.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “Calendar effects meant that it was always going to be challenging to match last year’s sales in April. However, with replenished inventory levels helping the market to recover a year ago, the industry is now facing a higher bar in order to keep growing. Lower pricing and higher incentives will likely be required to push sales up to the next level, but there are a number of headwinds keeping the market in check at present. Financing remains expensive due to the lack of movement in interest rates, and model year changeovers are further increasing MSRPs. Meanwhile, the bumpy roll-out of EVs continues to present difficulties, as new EVs are generally priced at too high a point to have mass appeal, while widespread availability is not always guaranteed”.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataUS inventory levels at the end of March rose to 2.6 million units, up 40% from March 2023 and 3% higher than February 2024. However, days’ supply slipped to 48 days from 50 days in February. Inventory of Small and Compact SUVs was up more than 60% from a year ago, which should be supportive of our forecast for the year. April is expected to continue the expansion of inventory, with volume projected to have increased 2% from March and days’ supply expected to increase back to 50 at the industry level.

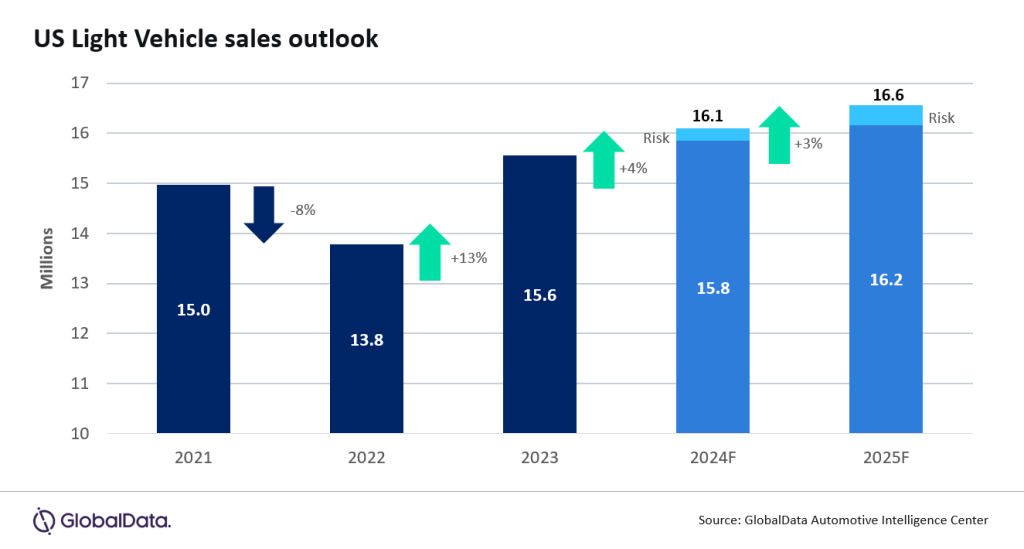

Much like the global outlook, the forecast for the US remains consistent with our previous forecast, up 4% to 16.1 million. Despite the slight pullback in April, fleet sales growth is expected to outpace that of retail sales, as fleet share of total LV sales is forecast to climb to 18.6%, the highest level since 2019. The outlook for LV sales in 2025 is holding at 16.6 million units, as sales growth moderates slightly to 3%.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “We are closely watching the availability of lower priced vehicles, which have lagged the recovery until recently. As entry-level inventory continues to rise and incentives increase to entice consumers still on the sidelines to re-enter the new vehicle market, we feel the market is poised to continue to expand, even if at a slower pace. However, the strength of the economy and likely longer road to lower interest rates may act as a constraint to any acceleration of growth this year, creating another challenge for the industry in setting near-term strategy as automakers and the supply base seek supply and demand equilibrium in the near-term environment.”

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center