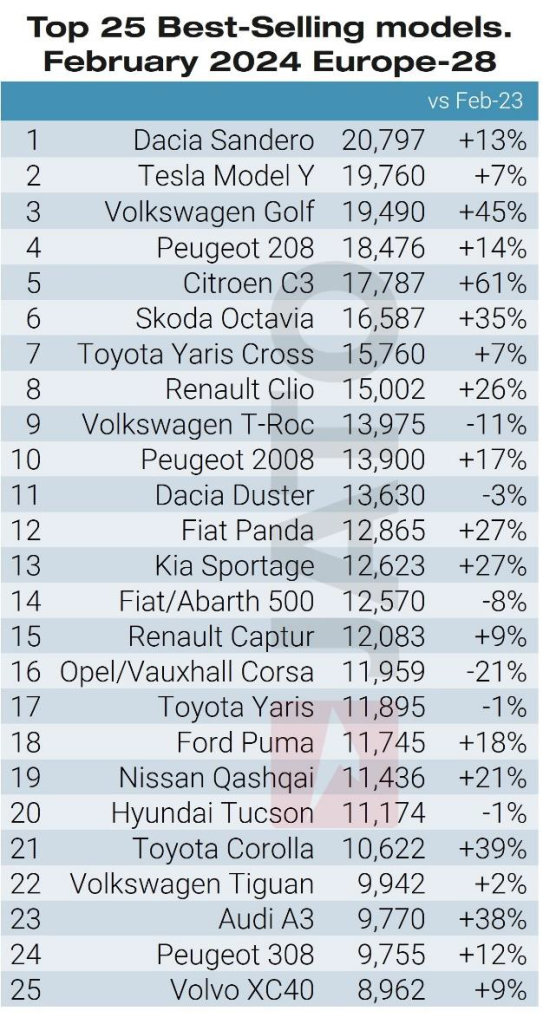

Dacia’s Sandero retained its position as the most registered car in Europe in February 2024, for the second consecutive month, with 20,800 units registered, an increase of 13% compared to February 2023.

The Tesla Model Y fell behind, having been the most registered passenger car in Europe last year while strong demand in key markets saw the Volkswagen Golf take third place, JATO Dynamics said.

Registrations of Citroen’s C3 increased 61% from February 2023, in part due to the competitive deals offered on the previous generation and prices introduced by the OEM as the new generation arrived.

The Skoda Octavia, Toyota Corolla, Audi A3, BMW X1, Seat/Cupra Leon, Tesla Model 3, MG Zs, and Opel/Vauxhall Astra also saw a rise in registrations.

Among the latest entries, Jeep registered 5,677 units of the Avenger, 1,434 of which were electric. Volvo registered 3,663 units of the EX30, and Renault registered 1,722 units of the Espace. Mitsubishi registered 1,535 and 1,339 units of the Colt and the ASX, respectively, and Honda registered 1,100 units of the ZR-V.

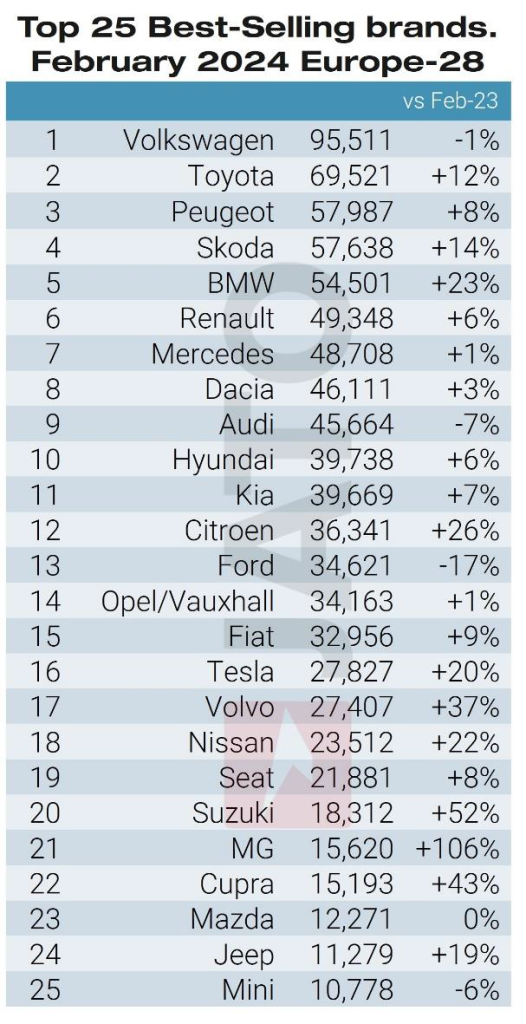

SAIC, parent company of MG and Maxus, continued to climb the rankings last month. Due to the popularity of its combustion engine models, it secured the highest market share increase of any OEM in February. Despite the strong performance of its electric models (the MG 4 was the fourth most registered electric car in February), petrol models were the main driver of growth for the manufacturer. As a result, MG registered more new cars than Cupra, Mazda, or Jeep during the month.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOther big players in February included Suzuki, BMW Group, Mitsubishi, and Toyota.

In contrast, Volkswagen Group, Ford, Renault Group, Mercedes, and Hyundai–Kia posted the biggest losses in market share.

In Europe, registrations of China made cars saw the highest levels of year on year growth last month (+45%) and in January-February (+43%).

By comparison, the registrations of cars made in Germany and Spain – the second and third most popular origins – saw increases of 6% each during February. This was the highest increase among the top 10 origins – allowing the market share for these vehicles to reach 4%, up from 3% in February last year. As a result, cars made in China outsold cars made in Italy, Korea, Morocco, and Romania, while also closing the gap between cars made in Turkey and the UK.

This growth was even stronger when looking at BEV registrations, with cars made in China accounting for one in five BEV registrations in February and January-February. In contrast, registrations of BEVs made in Germany increased by just 8% in the first two months of this year. The volume of plug in hybrid cars made in China fell by 62% last month, with these vehicles making up just 3.4% of the total coming from China, compared to 66% for BEVs.

JATO said: “The growth is partly explained by action taken by some Chinese OEMs to accelerate imports ahead of the EU decision on the anti-subsidy investigation. Increased tariffs could slow the growth of China’s OEMs, but as a knock-on effect it could also prompt them to accelerate their deliveries to Europe.”

Approximately 44% of all the volume of made-in-China cars were registered by western brands including Tesla, Volvo, and Dacia while 40% were registered by MG – fully Chinese-owned and designed, but positioned as a UK brand in the west.

This means that Chinese brands accounted for just 16% of Chinese made cars registrations, reinforcing the fact that these manufacturers continue to face challenges related to perception and awareness in Europe.

JATO added: “Chinese brands still have a long way to go before they occupy a significant part of the European market. Despite the strides they have made in regard to performance and affordability, increasing awareness and shifting long-standing perceptions will take time.”

A total of 988,116 passenger cars were registered in the EU28 in February. This was a 10% year on year rise and took the year todate total to nearly 2m units, up 11%.