As I remarked this time last year, the annual UN climate change gathering (this year’s is the 28th ‘Conference of the Parties’) doesn’t seem to be an event that gets the auto industry’s big guns out. While the formal COP28 sessions are mainly for politicians and experts with a sector-by-sector look at progress (or not – the so-called ‘stocktake’) and discussion of next steps, there’s a big informal aspect to the event where companies and others can choose to have stands, talk to delegates or the press, make presentations and so on. Some 75,000 attendees will be milling around at the COP28 event in Dubai.

The car companies and major suppliers have a good story to tell don’t they? Well, yes – but let’s put to one side the history of delivering fossil-fuel based products in transportation that have wrought a very heavy cost to the environment in terms of CO2 emissions. That’s very much what the industry would like to consign to the past but is something that can be uncomfortable to be reminded of. It’s still there, though the industry has massively cleaned up its act in terms of both emissions that are harmful to human health today and the greenhouse gas emissions that are potentially catastrophic for future generations.

Moreover, we stand at the brink of a revolutionary energy transition in vehicles that will see zero emission vehicles (battery electric vehicles) gradually replace – alongside more hybrids – pure fossil fuel burning cars and light commercial vehicles. The transition is underway in many mature markets, but there is obviously a long way to go.

While concerns inevitably remain over the full environmental impact of the industry in terms of manufacturing activity as well as vehicles in use, there is progress there, too. All along the automotive value chain, companies are giving much higher priority to sustainability policies and the measures that support them. This is not only born out of a shared sense of what is the right thing to do for the planet, but also the growing realisation that lower energy inputs, renewable energy sources and using sustainable materials wherever possible are also a route to lowering costs. With company profit margins under pressure due to much higher energy and material costs, the business case alone for reviewing processes and realising more sustainable solutions is a highly compelling one.

The industry also has a new focus on its supply chains – something that will be particularly important as supply chains are reconfigured away from ICE powertrains and parts to electric powertrains. Gigafactories to supply batteries are but one element; there are a whole load more suppliers and manufacturing capacity needed for future electric motors, inverters and other major EV components.

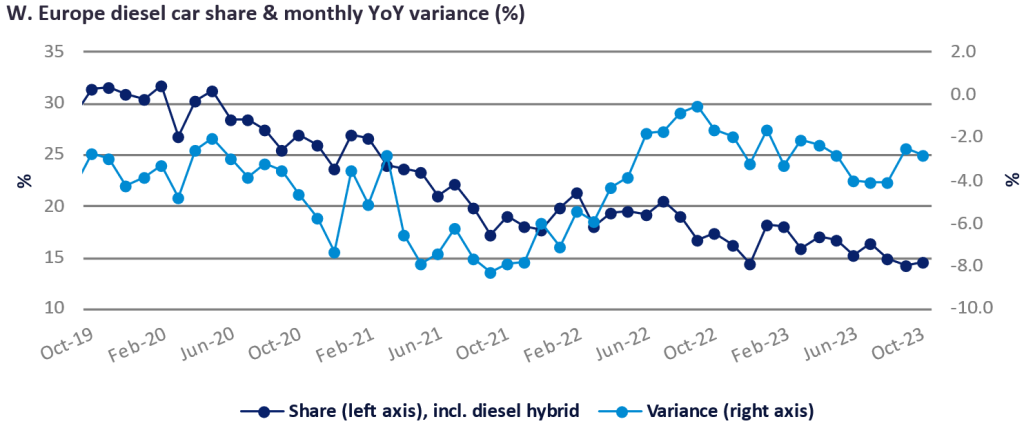

This structural change to the auto industry’s make-up is proceeding apace, with major Tier 1 suppliers reorganising operations for ramped up future electric vehicle supply. Mahle, for example, is a company that realises being an efficient specialist and supplier of vital ICE parts such as piston rings is no longer a sound recipe for long-term business health when ICE-fitted cars become a diminishing minority. The decline of diesel share of the new car market in Western Europe (see chart below) in recent years illustrates how quickly the accepted industry status quo and associated business planning assumptions can change. Many suppliers’ operations are now being rebalanced, with some ‘sunset’ units being divested, even if they are currently profitable. We’re going to see more of that structural change over the next five years, with M&A activity likely to increase.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

When it comes to automotive supply chains, transparency is going to become absolutely key to delivering on both cost efficiency and increasingly needed provenance in areas such as whole product sustainability and ethics. As companies plot their routes to carbon net zero (typically a long way out – by 2050 – but there is a pathway and progress to consider), there is bound to be an increasing focus on the integrity of supply chains and inter-company procurement relationships at all points. Transparency of complex automotive supply chains – or rather the lack of transparency – has emerged as an urgent issue whenever companies have faced unforeseen disruption. The semiconductors shortage of the last few years illustrated the fragility of supply chains that are ultimately as strong as their weakest link, with companies unable to finish vital parts or whole cars. Risk mitigation alone brought a realisation that systems and processes need an overhaul, with better technological solutions to track standards and company actions all along the automotive value chain.

The IEA estimates that transport as a whole accounts for 38% of end-use carbon emissions and road transport accounts for the majority of that. There’s a pretty positive story around how the transport industry – which we all depend on – is dealing with that. There is a lot going on and a lot that the auto industry’s main participants could usefully communicate.

Don’t miss our coverage of COP28! Subscribe here for exclusive insights & analysis.It is multi-faceted and undeniably complex to reduce to simple stats. Besides more zero emission vehicles in use there are many initiatives to reduce the environmental impact of factories, to use more green steel, aluminium, to recycle more material, to employ circular recycling techniques in design and much more.

There are so many positive stories to tell and it’s perhaps a pity that more of that doesn’t get out at events such as COP28. To be fair to the auto industry though, the annual COP meetings are not the only game in town.

For example, the World Climate Summit bills itself as an ‘investment COP’ for private companies. At that event earlier this year, Ralf Pfitzner, Head of Sustainability at the Volkswagen Group, stressed the importance of the industry working together. VW Group aims to be carbon neutral by 2050 at the latest. There is also an intermediate target of reducing carbon emissions by 30% by 2030 (versus 2018) over the entire lifecycle of passenger and light duty vehicles. That would be some achievement and would include the use-phase of the vehicles, as well as the carbon emitted in their manufacturing at VW Group plants but also – crucially – also include VW’s supply chain. The information flows alone are going to be challenging, but digital tech and tools such as blockchain can certainly help.

Pfitzner also pointed out that the endeavour is not something that even a huge company like VW can tackle alone. “The World Climate Summit brings together a huge crowd of engaged business people, all across the value chain,” he said. “It is an excellent opportunity to network, drive our sustainability agenda, have business conversations – with potential suppliers, with [our] partners on the investment side – that help us jointly drive the sustainability and decarbonisation agenda. We believe we can’t do that alone – that huge endeavour of decarbonising individual mobility. We have to work together.”

And that sums it up very neatly: We have to work together, wherever we are. A lot is happening already but more conversations about shared goals and procurement policies will be needed across the auto industry (like other industries). The challenges ahead are going to be big, but everyone in the industry is acutely aware of that. It may not be obvious at the COP28 event or in the noise that emanates from the attendant media scrums, but there are plenty of valuable initiatives and conversations – that are good for the environment and for business – going on across the automotive sector.

As an old British telecomms ad tagline put it: It’s good to talk.